exemption under section 127

The Electronic Code of Federal Regulations eCFR is a continuously updated online version of the CFR. Ii land which is mostly under water produces little if any income and has no use except for wildlife or water conservation purposes provided it is preserved in its natural condition and drainage of it would be legal feasible and.

Exemption for emergency vehicles.

. It is exempt from taxation under section 501c of the Internal Revenue Code. Compensation payable to third parties. Applications under section 125.

A section 218 agreement may apply to students at a secondary school as well as to students at an institution of higher. Nonmembers may only use the facilities at the request and in the presence of a member. Grant or refusal of licences.

Most of the original guidance remains the same but limited changes have been made as a result of. Changes following determination on reference under section 120. If no page limit for an attachment is listed in either the Table of Page Limits Section IV of the FOA under Page Limitations or in a related NIH Guide notice you can assume the attachment does not have a limit.

Together with the Health Care and Education Reconciliation Act of 2010 amendment it. 127 E dated 19022019 issued by Department for Promotion of Industry and Internal Trade DPIITthe following will be considered as a Startup -. A exceed the speed limit.

As an initiative of the US. Designations under section 56. Department of Educations Institute of Education Sciences IES the What Works Clearinghouse WWC was created in 2002 to be a central and trusted source of scientific evidence for what works in education.

As laid down in the Notification No. A A person claiming an exemption from a required immunization based on reasons of conscience including a religious belief under Section 161004 of this code Section 38001 519192 or 51933 Education Code or Section 42043 Human Resources Code must complete an affidavit on a form provided by the department stating the reason for the. The CCD School Locator was created to enable the public to find the correct name address telephone number NCES ID number urbanicity rural large city etc and other student and teacher information for public schools as reported to.

T Notwithstanding Section 1143c an exemption under this section does not terminate because of a change in ownership of the property if. For purposes of this subdivision wetlands means. 2 or 3 4 Subject to subsection 5 the exemption under subsection 2 or 3 does not apply with respect to a rental unit that is subject to a tenancy in respect of which a tenancy agreement was entered into on or before November 15 2018.

ETT and SDI there is an exemption if at the time of payment it is reasonable to believe that the employee is entitled to a deduction under Section 217 of the. Members have free use of the organizations facilities including the golf course health spa meeting rooms and cafeteria. 12 6-17 INTERNET Page 2 of 4.

It has 200 members who provide all operating revenue. I land described in section 103G005 subdivision 15a. The student FICA exception does not apply to services which are covered by an agreement to provide social security coverage under section 218 of the Social Security Act section 218 agreement.

Employees that are not excludable from gross income under Section 127 of the Internal Revenue Code. Power to veto changes proposed under section 122. Article Explains Exemption Deduction under Section 54 Section 54EC Section 54F of Income Tax Act 1961 with FAQs and Case Laws.

This enforcement guidance supersedes the enforcement guidance issued by the Commission on 030199. 122 1 Despite anything in this Part but subject to subsections 2 and 4 a driver of an emergency vehicle may do the following. Power to supply furniture.

Determination on reference under section 120. Non-application of exemption under subs. S-1 For property described by Subsection f2 the amount of the exemption under this section from taxation is 100 percent of the appraised value of the property.

Acts 1987 70th Leg ch. IRC Section 3121b7 E. Temporary exemption from licensing requirement.

It explains regarding Capital Gain Account Scheme deduction on multiple sales purchases of residential houses capital gains arising from sale of more than one house however the sale proceeds are invested in one. Get all the latest India news ipo bse business news commodity only on Moneycontrol. Local modifications of prices.

The Sandy Hook Elementary School shooting occurred on December 14 2012 in Newtown Connecticut United States when 20-year-old Adam Lanza shot and killed 26 peopleTwenty of the victims were children between six and seven years old and six were adult staff members. The Affordable Care Act ACA formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare is a landmark US. B Similarly an attempt to violate any of the conditions under which a temporary export or temporary import license was issued pursuant to this subchapter or to violate the requirements of 1232 of this subchapter also constitutes an offense punishable under section 401 of title 22 of the United States Code and such article together with.

Earlier that day before driving to the school Lanza shot and killed his mother at their Newtown home. H To the extent federal law requires this state to issue a special permit under 23 USC. Videos cannot be imbedded in an application but are accepted under limited circumstances as post-submission material.

Federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23 2010. It is not an official. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government.

Section 127 or an executive order a suspension issued under Subsection f is a special permit or an executive order. In the event of a conflict between this section as it relates to requests made under this section and other provisions of law the other provisions of law including court sealing orders that restrict disclosure of criminal investigative files shall control. If an exporter claims an exemption under Section 162104a4 or 162204a4 and fails to report subsequent tax-free sales in this state of the motor fuel for which the exemption was claimed as required by Section 1621155 or 1622165 or to produce proof of payment of tax to the destination state or proof that the transaction was exempt in.

Local modifications of prices. C disregard rules and traffic control devices governing direction of movement or turning in. Memorandum of association for Pvt Ltd or LLP Deed for LLP.

State Area Data About this section Occupational Employment and Wage Statistics OEWS The Occupational Employment and Wage Statistics OEWS program produces employment and wage estimates annually for over 800 occupations. Not Subject Not Subject. Details required to make the application for exemption under section 80IAC are.

These estimates are available for the nation as a whole for individual states and for metropolitan and. EEOC Enforcement Guidance on Reasonable Accommodation and Undue Hardship Under the Americans with Disabilities Act PURPOSE. B proceed past a red traffic control signal or stop sign without stopping.

2020 Cares Act Repay Employee Student Loans Up To 5 250 Tax Free Extended Through December 31 2025 Core Documents

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Documenting Covid 19 Employment Tax Credits

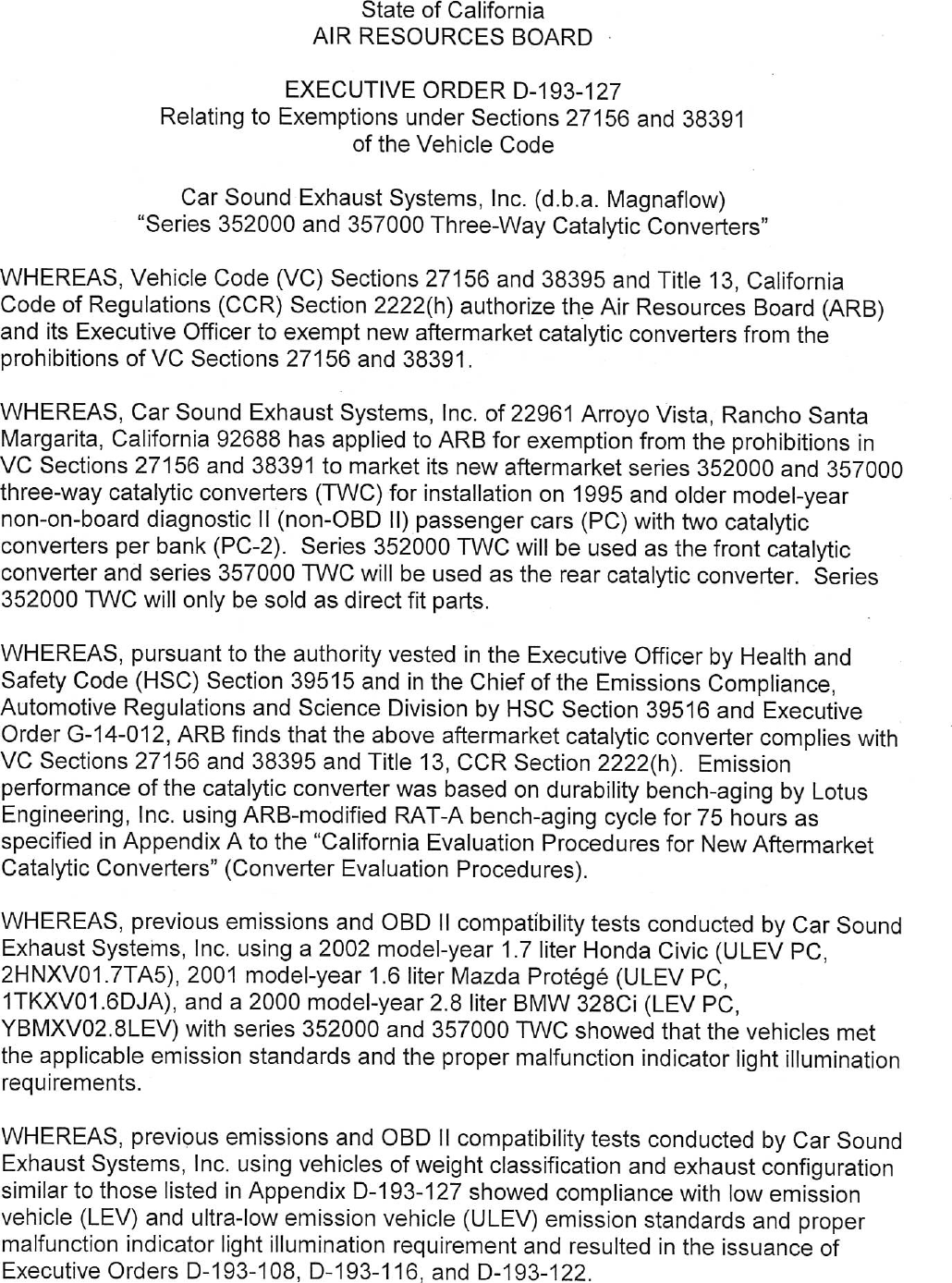

Executive Order D 193 127 Car Sound Magnaflow

The Financial Insurance Investment Blog Income Tax Exemption No 11 Order 2006 P U A 112 2006 Income Tax Act 1967 And Income Tax Act 1967 Part Ix Exemptions Remission And Other Relief

Cafeteria Plan Compliance Journal Of Accountancy

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Designing And Managing Educational Assistance Programs

Roberts Court Bankruptcy Decisions List Lsta

Ktps Consulting Income Tax Exemption Order 2021 Facebook

Bulletin Sst 127 Oil And Gas Industry Exploration Discovery And

Cares Act Expands Section 127 Of The Irc Tax Savings Available Berrydunn

Circular Letter From Elks Lodge No 127 To W E B Du Bois Ca January 1933

Chapter 5 Section 127 Pdf Stocks Initial Public Offering

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

Comments

Post a Comment